As a result, the savings account price at several of the largest retail financial institutions has been floating near all-time low, currently a mere 0.06%, generally. If you can not make a down payment of 20 percent or more, lenders will normally need you to purchase home mortgage insurance coverage, in some cases known as private mortgage insurance coverage. Mortgage insurance, which shields the lender in the event a borrower quits paying their finance, adds to the total cost of your regular monthly mortgage loan settlement.

- We are an independent, advertising-supported comparison solution.

- The highest possible paying easy-access account has an interest rate of 0.71%.

- When you're buying a home loan, compare rates of interest and APR, which is the overall price of the home mortgage.

- Various loan provider can Click for info supply different funding products and prices.

- In comparison to home mortgage holders, a base rate rise is a favorable for savers.

- As that consensus solidifies prior to an FOMC conference, home loan prices typically drift in the instructions that the Fed is expected to relocate.

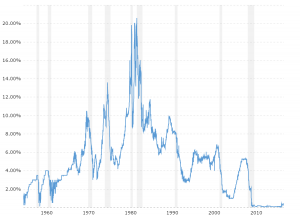

The revenue you obtain can be locked in on the day you acquire your annuity (based on indexing etc.), so existing annuity prices can make a big distinction to your long-term financial safety and security. In addition to mortgages, Bank Rate also affects the interest rates billed on other forms of credit rating, such as bank card lendings, bank loans, and also car loans. So also if you do not have a home loan, adjustments in rate of interest might still have an impact on your financial resources. The secondary market where capitalists acquire mortgage-backed safeties contributes. Most loan providers pack the mortgages they underwrite and offer them in the second marketplace to financiers. When financier need is high, mortgage rates trend a little bit reduced.

Use Calculators

If you do not understand your credit report, there are several means to get it. There are a host of various aspects that go into exactly how a lending institution establishes the rates of interest on its mortgage variety. This is because you're paying a bit a lot more for the protection of knowing what your repayments will certainly resemble on a monthly basis. With a lot of mortgage deals, your interest rate will certainly revert to your lending institution's SVR after the first duration pertains to an end. SVRs tend to be fairly high, so it timeshare freebies typically makes sense to switch over - or remortgage- before you're moved onto the SVR. While your loan provider may not increase its SVR by the full amount, it's still very likely that your payments will certainly enhance.

Compare Travel Cash

There will certainly likewise be fewer dollars in your finance gathering interest. Knowing the advantages and also disadvantages of the kinds of home loans is necessary when comparing interest rates among different lending institutions. When it involves changes to the rate of interest, Hop over to this website the majority of loan providers consider the cash price in addition to their expense of funds. The Fed started to buy numerous billions of dollars' worth of Treasurys as well as mortgage-backed protections to keep cash in the financial system and to maintain long-lasting interest rates down. The FOMC likes to give investors a heads-up whenever it intends to elevate or reduce short-term interest rates. Participants of the board advertise their intents by sprinkling tips right into their public speeches.

House owners in cities with expensive real estate, like Vancouver and also Toronto, might pay hundreds of dollars much more on normal mortgage payments. Greater interest rates likewise affect credit lines along with auto and also trainee financings. Exactly How the Federal Reserve impacts home mortgage prices and how increasing interest rates affect house prices are simply part of the challenge for tenants. When questioning whether to rent or buy, there are numerous expenses to remember.

In response, the Federal Get revealed it would get billions of bucks in Treasuries and also mortgage-backed securities, or MBS. The move was to sustain the flow of credit rating, which assisted press home loan prices to tape lows. The Federal Book establishes loaning costs for shorter-term car loans in the U.S. by relocating its federal funds price.